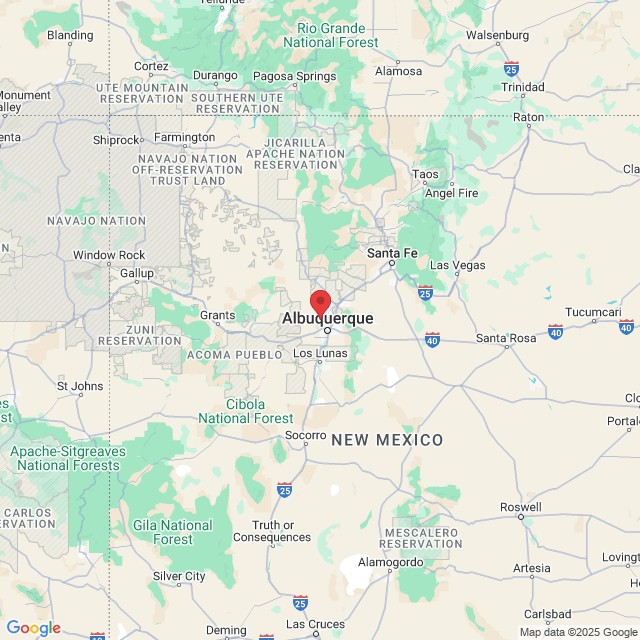

The Clowe Agency

Committed To Helping You And Your Loved Ones...

When It Matters Most

Life, Medicare, Health Insurance provide crucial health and financial security in times of need. We are committed to help you and your loved ones...

when it matters most.

DID YOU JUST DISCOVER YOUR PRESCRIPTION DRUG PLAN HAS A DEDUCTIBLE? WE CAN HELP!

(505) 306-3811

Compare prices among the nation’s most Trusted Insurers

Compare Prices Among the Nation’s Most Trusted Insurers

Get a Personalized Life or Health Insurance Quote

Complete the short survey below to receive a personalized quote from The Clowe Agency

Why should you work with The Clowe Agency

Our Trusted Advisors have access to a broad array of life and health insurance companies and products, and can help you with a variety of insurance needs, including Medicare Advantage and Supplement Plans, Final Expense, Mortgage Protection, Retirement Planning, and more.

Our Trusted Advisors undergo periodic and rigorous Continuing Education training, and are fully recognized by each state as AHIP Certified and a NIPR™️Trusted Advisor.

Expertise

Our Trusted Advisors are trained professionals who have a deep understanding of the different types of life and health insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

Our Trusted Advisors are a more convenient choice than trying to research and compare policies all on your own. We're here to do the legwork for you, comparing quotes from multiple life and health insurance companies and helping you understand the terms and conditions of each policy.

Committed to Service

Our Trusted Advisors provide personalized service and support to help you choose the right policy for your unique situation. We take the time to understand your health, financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

Services We Offer

Ready to Plan for Your Family’s Future?

Book a meeting with us below to discover your options

What is a Modified Endowment Contract?

Updated on November 21, 2023

Written by Ashley Kilroy

Life insurance policies are attractive vehicles providing tax-advantaged growth that the stock market doesn’t hinder. As a result, throwing as much money as possible into the account can be tempting. After all, who wouldn’t want to maximize their gains? Unfortunately, contributing too much money into your account can result in the policy becoming a Modified Endowment Contract (MEC). This account designation is unchangeable once assigned and produces different implications for taxes and cash value access. Here are the details and how to use the Seven-Pay Test to stay on the straight and narrow. You may also want to work with a financial advisor to help you make the right long-term financial decisions.

A Modified Eendowment Contract (MEC) is a former life insurance policy that has lost specific advantages due to accumulating too much surplus cash. For instance, permanent life insurance policies, such as whole life insurance, defer taxes on growth.

In addition, the policy’s cash value can combine with your death benefit for a higher payout to your beneficiaries. However, a MEC irreversibly restricts access to the account’s cash value until the policyholder is age 59.5. Withdrawing money before then will incur a 10% penalty.

History of the MEC

In 1988, Congress established the MEC rule because life insurance was being used as a means to avoid capital gains taxes instead of its intended purpose of providing a death benefit for families. During the 1970s to mid-1980s, long-term capital gains taxes ranged from 20 percent to 39 percent. So, consumers could purchase life insurance policies that allowed hefty upfront payments or a single premium payment and defer taxes on the accumulated cash value.

In addition, they could take out tax-free loans from the policy, which could last a lifetime and be repaid from the eventual death benefit. However, the Technical and Miscellaneous Revenue Act of 1988 stopped this practice by introducing the Seven-Pay Test, which identifies policies bought for investing and tax-sheltering instead of the death benefit and gradual growth.

What Is the Seven-Pay Test?

The Seven-Pay Test is how the government determines if a life insurance policy turns into a MEC. Specifically, the test limits how much the policyholder can deposit annually during the first seven years. If the policyholder exceeds the limit with their contributions and doesn’t initiate a refund for the overage, the policy becomes a MEC.

For example, say you open a $250,000 life insurance policy. It has a $5,000 MEC deposit limit. So, you can deposit $5,000 per year for the first seven years of the policy. However, if you were to deposit over $5,000 during any of those seven years, the government would consider the policy a MEC and tax it accordingly.

This rule applies even if you try to make up for a year when your contributions for $5,000. For instance, funding the policy with $4,000 in year one and $6,000 in year two would put your policy into MEC status. Fortunately, if you overpay into your policy, your insurance company will notify you. Then, you can opt for a refund of the surplus payments to retain your policy’s status.

Lastly, it’s key to remember that policies that went into effect before June 20, 1988, aren’t subject to this law because it wasn’t in place yet. Plus, after the first seven years, the rule goes away for your policy unless you make a major adjustment, such as raising the death benefit.

Pros and Cons of MECs

As outlined above, MECs lose the cash value component of the death benefit. For instance, a $250,000 whole life policy that has accumulated $75,000 offers substantial cash reserves. However, if it becomes a MEC, you lose access to that money until age 59.5 unless you’re willing to pay a 10% withdrawal penalty.

In addition, your policy gains the same tax status as a non-qualified annuity, meaning you pay taxes on earnings. The final drawback is that MEC status is permanent once it occurs.

On the other hand, MECs still provide a death benefit to your beneficiaries. Plus, you’ll still experience the steady growth your life insurance policy originally offered and avoid the unpredictability of the stock market.

MEC Tax Consequences

Permanent life insurance policies shield earnings from taxes, meaning your money grows faster. Plus, you can take withdrawals or loans from your policy without incurring taxes if the amount is under the policy’s cost basis. In addition, you don’t have to be a specific age to touch the money in your life insurance policy. Contrastingly, MECs lack these benefits. When you withdraw funds, your earnings come out first, meaning you pay income taxes on withdrawals. Plus, you must wait until age 59.5 to withdraw cash or pay a 10% penalty to do so beforehand.

Who Can Benefit from MECs

Although MECs experience a downgrade from a typical permanent life insurance policy, they still provide advantages. Specifically, if you want a tax-advantaged payout for your beneficiaries and aren’t bothered by overfunding your policy, a MEC can help. In addition, you won’t pay taxes on the money in your policy until you withdraw it. Therefore, high net-worth individuals might find MECs desirable.

The Bottom Line

A MEC is a life insurance policy that has received excessive deposits over the first seven years of its existence. Violating the Seven Pay Test produces an irrevocable change to the policy and it becomes a MEC. Your access to the policy’s cash is limited to age 59.5 and you might pay more taxes on the policy than originally planned. However, MECs still retain the primary function of life insurance: providing a hefty payout to beneficiaries upon the policyholder’s death.

Modified Endowment Contract Tips

Avoiding MEC status can help your life insurance policy function as intended. If you’re confused about how your insurance impacts your financial circumstances, a financial advisor can help. The Clowe Agency has a dedicated Simple Retirement Solutions© team to consult and advise you to achieve your financial goals.

COMPANY

INSURANCE NEEDS

CUSTOMER CARE

LEGAL

Copyright 2026. The Clowe Agency. All Rights Reserved.