Enjoy predictable and affordable protection

Term Life Insurance

✅ No Medical Exams or Visits

✅ Term Lengths from 10 - 30 yrs

✅ Simple...Easy to Understand

✅ Return of Premium Options

✅ NO COST Living Benefits Riders

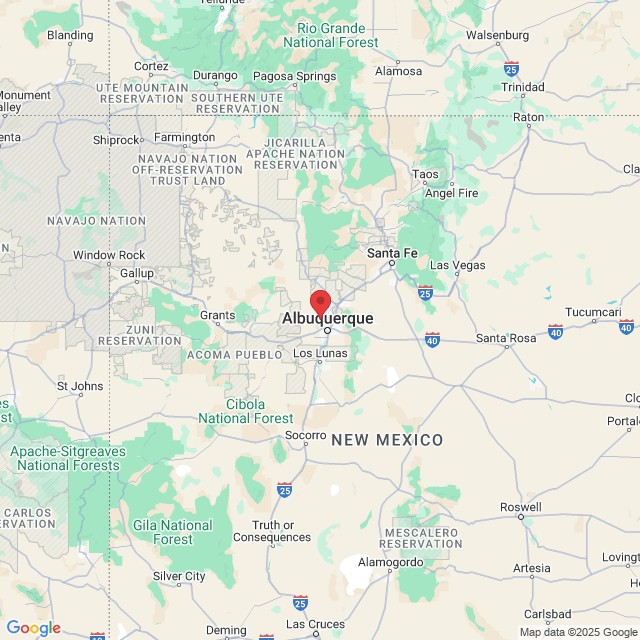

Compare prices among the nation’s most Trusted Insurers

We Work with Companies You Can Trust

Get a Personalized Term Life Quote

Complete the survey below to get a personalized quote from us

What is Term Life Insurance?

Term life Insurance is a type of life insurance policy that provides coverage for a specified period, or "term," of time. Typically, this term can range from 10 to 30 years, depending on the policy terms and the preferences of the policyholder. If the insured individual passes away during the term of the policy, the insurance company pays out a death benefit to the beneficiaries named by the policyholder.

How Term Life Insurance Benefits You

Simple and Easy to Understand

Also known as "Pure Life Insurance", term life insurance tends to be easier to understand than other types of life insurance, such as whole life or universal life insurance, because it provides coverage for a specific period, for a specific price. There are no price increases and the death benefit is paid out to your beneficiaries...usually tax-free.

Renewability and Convertibility

Some term life insurance policies offer the option to renew the coverage at the end of the term, often at a higher premium. Additionally, many policies include a conversion option, allowing policyholders to convert their term policy into a permanent life insurance policy without undergoing a medical exam. Make sure you understand how and when you can renew or convert your term life policy.

It Provides Peace of Mind

Purchasing term life insurance provides peace of mind, knowing that your loved ones will be financially protected in the event of your death. It helps you feel confident that your loved ones will be able to maintain their standard of living, even if you are no longer there to provide for them.

It Is Typically Less Expensive Than Other Types Of Life Insurance

Because term life insurance is specifically designed to provide financial protection for a set period (term) of time, it is typically less expensive than other types of life insurance. Term life insurance is a desirable choice for individuals who want coverage for a specific period, such as until their mortgage is paid off, their children are financially independent, or during their working years when their income is crucial to their family's well-being

Things to Consider with Term Life Insurance

Determine the Proper Amount of Coverage Needed

Determine the amount of coverage (death benefit) you need based on your financial obligations, such as a mortgage, debts, education expenses, and income replacement for your dependents. A good rule of thumb is to aim for coverage that is 8 to 10 times your annual income. We can help with the proper amount of coverage based on your unique needs.

Determine the Proper Amount of Length of Term Needed

Choose a term length that aligns with your financial goals and obligations. Consider factors such as the age of your dependents, the duration of your mortgage or other debts, and the number of years until your retirement. Term life insurance is a desirable choice for individuals who want coverage for a specific period, such as until their mortgage is paid off, their children are financially independent, or during their working years when their income is crucial to their family's well-being.

The Terms and Conditions of the Policy

It's important to carefully read and understand the terms and conditions of any term life insurance policy you're considering. This will help you understand what is and is not covered, and any exclusions or limitations that may apply. Already have a policy? Does it have a convertability clause? How long is the contestability period? Let us take a look, and we'll let you know all of that and more...

Why should you work with The Clowe Agency

Our Trusted Advisors have access to a broad array of life and health insurance companies and products, and can help you with a variety of insurance needs, including Medicare Advantage and Supplement Plans, Final Expense, Mortgage Protection, Retirement Planning, and more.

Our Trusted Advisors undergo periodic and rigorous Continuing Education training, and are fully recognized by each state as AHIP Certified and a NIPR™️Trusted Advisor.

Expertise

Our Trusted Advisors are trained professionals who have a deep understanding of the different types of life and health insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

Our Trusted Advisors are a more convenient choice than trying to research and compare policies all on your own. We're here to do the legwork for you, comparing quotes from multiple life and health insurance companies and helping you understand the terms and conditions of each policy.

Committed to Service

Our Trusted Advisors provide personalized service and support to help you choose the right policy for your unique situation. We take the time to understand your health, financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

Key Features of Term Life Insurance

Term life insurance is often chosen by individuals who want to ensure financial protection for their loved ones during a specific period, such as when they have young children, outstanding debts, or a mortgage. It provides a straightforward and cost-effective way to provide a death benefit if the insured passes away unexpectedly during the term of the policy.

Coverage

This is the amount of money that the insurance company will pay out to ease your loved ones if you pass or become disabled during the term.

Premiums

These are the regular payments that the policyholder makes to the insurer in order to keep the policy in force.

Policy Length

Most term life insurance policies have a set length of time, such as 10, 20, or 30 years, during which the policy is in force.

Riders

These are optional additions to a policy that provide additional coverage for specific events or circumstances. For example, a policy may include a rider that provides additional benefits if the policyholder becomes disabled and is unable to work.

Cancellation

Most term life insurance policies can be cancelled at any time by the policyholder, by simply stop paying premiums. The policy will lapse, and you will lose coverage.

By carefully considering these factors and conducting thorough research, you can make an informed decision when purchasing term life insurance that provides financial protection for your loved ones in the event of your untimely death. Let us help.