The Clowe Agency

Committed To Helping You And Your Loved Ones...

When It Matters Most

Life, Medicare, Health Insurance provide crucial health and financial security in times of need. We are committed to help you and your loved ones...

when it matters most.

DID YOU JUST DISCOVER YOUR PRESCRIPTION DRUG PLAN HAS A DEDUCTIBLE? WE CAN HELP!

(505) 306-3811

Compare prices among the nation’s most Trusted Insurers

Compare Prices Among the Nation’s Most Trusted Insurers

Get a Personalized Life or Health Insurance Quote

Complete the short survey below to receive a personalized quote from The Clowe Agency

Why should you work with The Clowe Agency

Our Trusted Advisors have access to a broad array of life and health insurance companies and products, and can help you with a variety of insurance needs, including Medicare Advantage and Supplement Plans, Final Expense, Mortgage Protection, Retirement Planning, and more.

Our Trusted Advisors undergo periodic and rigorous Continuing Education training, and are fully recognized by each state as AHIP Certified and a NIPR™️Trusted Advisor.

Expertise

Our Trusted Advisors are trained professionals who have a deep understanding of the different types of life and health insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

Our Trusted Advisors are a more convenient choice than trying to research and compare policies all on your own. We're here to do the legwork for you, comparing quotes from multiple life and health insurance companies and helping you understand the terms and conditions of each policy.

Committed to Service

Our Trusted Advisors provide personalized service and support to help you choose the right policy for your unique situation. We take the time to understand your health, financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

Services We Offer

Ready to Plan for Your Family’s Future?

Book a meeting with us below to discover your options

Top Life Insurance Statistics for 2024

In this article, we presented an overview of the most compelling life insurance statistics going into the new year, using data from sources like the American Council of Life Insurers (ACLI), Life Insurance Marketing and Research Association (LIMRA) and the Insurance Information Institute (Triple-I).

If you are interested in purchasing a life insurance policy, consider your financial condition and future goals to find the best life insurance for your needs.

Key Life Insurance Statistics

A study by the LIMRA and Life Happens shows that in 2023, the percentage of people who reported having life insurance increased to 52%, up from 50% in the previous year.

But, over the past 12 years, there has been a decrease in overall life insurance ownership, dropping from 63% in 2011, to 52% in 2023... that is an 11% drop.

About 100 million Americans are either without life insurance or inadequately insured, acknowledging their need for additional coverage, according to data from LIMRA.

,A record high of 30% of consumers have indicated their intention to buy life insurance in the upcoming year, also according to LIMRA data.

Another LIMRA study found that the primary reason for owning life insurance is to fund funeral or burial and other end-of-life expenses.

Data from Aflac shows that, on average, life insurance policies pay out on average $168,000, but this amount can vary significantly based on the policy. The Clowe Agency is appointed with Aflac.

According to the Triple-I, in 2022, the total amount of life insurance benefits and claims amounted to 797.7 billion.

How Much Does Life Insurance Cost?

The cost of a life insurance policy depends on several factors, including age, gender, medical history, lifestyle and your chosen coverage amount. This means your premium will differ from average policy costs. The following figures and statistics can help you make informed decisions regarding the best life insurance option for your situation.

The above-cited LIMRA study shows that 42% of consumers do not purchase life insurance because of its high cost.

Additionally, over half of Americans overestimate the cost of life insurance, believing it to be three times more expensive than it is. This is why it’s important to understand how insurers calculate the cost of life insurance.

Based on our research, the average month premium for a healthy, non-smoking, 35-year-old man with a $500,000 policy is ~$36.

According to LIMRA, 38% of Americans reported that their household would face financial difficulties within six months if a breadwinner were to pass away, with 30% facing such challenges within a month.

What Are the Different Types of Life Insurance?

You can choose from many types of life insurance, each with its unique features and benefits. Knowing about different options can help you decide which suits you best based on your needs. Here are the main types of life insurance available in the market:

Term life insurance: This type of policy will cover you for a specific period, such as 10, 20 or 30 years. It has low premiums and is ideal for those seeking coverage for a limited time, such as a the term of a mortgage or until children are grown and your needs change.

Whole life insurance: A whole life policy includes lifelong coverage, a death benefit and a cash value component. It costs more but will suit those who want permanent coverage and to accumulate cash value.

Indexed Universal life insurance (IUL's): Similar to a whole life policy, an indexed universal life insurance policy provides lifelong coverage but has flexible premiums and death benefits. Its cash value grows according to a specified indexed interest rate (ie, S&P 500) and is best for those who want to be able to modify their policy in the future to meet their changing needs. IUL's can also be designed to provide supplemental retirement income.

Variable life insurance: This policy type is riskier than other forms of permanent coverage as its cash value is invested in various accounts and can fluctuate based on performance. However, it offers a higher growth potential than other options, but usually costs more than other forms of life insurance.

Group life insurance: A group life plan has lower premiums and coverage is generally easier to qualify for, often without a health exam. You can get it through your employer as part of your benefits package. Once you separate from your company, most group plans do not convert to personal life insurance.

Life Insurance Demographic Trends

Coverage preferences for life insurance can vary based on age groups, genders, socioeconomic backgrounds and other factors. The following trends, which we obtained from the above-mentioned LIMRA study, can give you key insights into the relationship between demographic factors and insurance choices.

The LIMRA study found that Hispanic Americans have a lower rate of life insurance ownership, with 45% reporting they have coverage, which is below the rates for other racial and ethnic groups.

While 41% of single mothers own life insurance, a higher percentage (59%) recognize the need for buying life insurance or enhancing existing coverage.

Life insurance ownership among women is lower compared to men, with 49% of women owning a policy as opposed to 55% of men. This trend marks the fifth consecutive year of declining life insurance ownership among women.

The percentage of parents who own life insurance has increased to 59%, rising from 54% in the previous year.

The study shows that in the next year, a greater percentage of younger demographics, with 44% of Gen Z and 50% of millennials, intend to buy life insurance, surpassing the national average.

Life Insurance Policy Statistics

Knowing which types of policies are popular among consumers can help you understand the current state of the insurance market. Here are some policy statistics related to life insurance:

Data from the ACLI shows that in 2022, term life insurance accounted for 39.3% of all life insurance purchases.

Term life insurance represented a substantial 70.5% of the total face amount issued for individual life policies, totaling $1.3 trillion.

In 2022, permanent life insurance policies made up 60.7% of all life insurance purchases.

The Bottom Line

A new LIMRA study shows that 39% of consumers plan to purchase life insurance within the following year. If you’re one of them, understanding the trends within the life insurance industry can help you make decisions when choosing a policy. Different types of policies are available and it is best to evaluate your needs to select the right one.

Although you can estimate pricing based on the average cost of life insurance, your actual cost will depend on your situation. Your location significantly affects your premiums and the death benefit your family receives. If you need help selecting a life insurance policy, we recommend speaking with a registered life insurance agent

Saad Imran Author

Saad Imran is a personal finance writer with expertise in insurance, loans, credit cards and mortgages. When not writing, he’s a cat enthusiast who loves playtime with his furry companion.

Tori Addison Editor

Tori Addison is an editor who has worked in the digital marketing industry for over five years. Her experience includes communications and marketing work in the nonprofit, governmental and academic sectors. A journalist by trade, she started her career covering politics and news in New York’s Hudson Valley. Her work included coverage of local and state budgets, federal financial regulations and health care legislation.

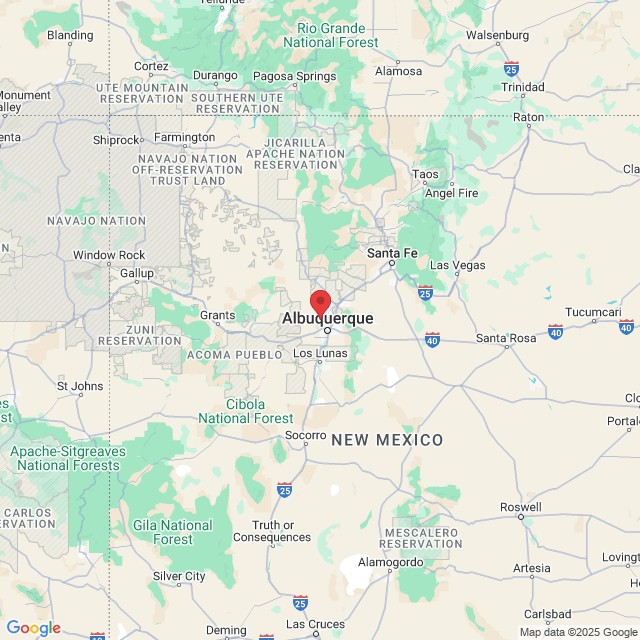

6700 Cantata St. NW Ste. 205

Albuqeuerque, NM 87114

(505) 306-3811

COMPANY

INSURANCE NEEDS

CUSTOMER CARE

LEGAL

Copyright 2026. The Clowe Agency. All Rights Reserved.