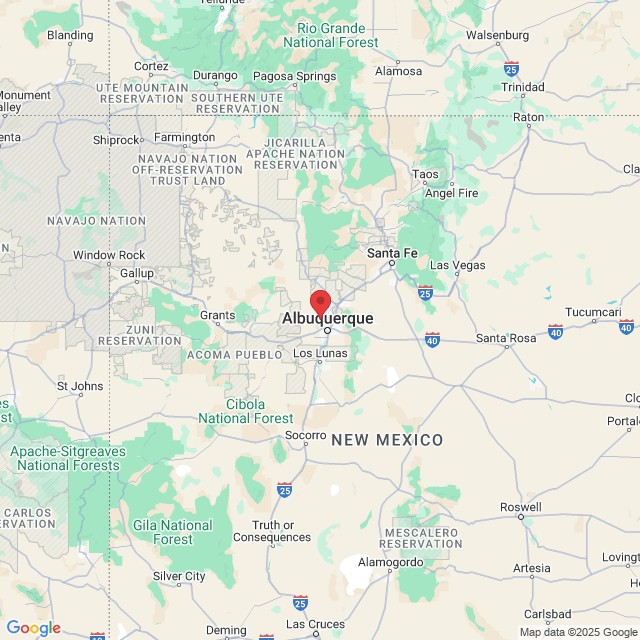

The Clowe Agency

Committed To Helping You And Your Loved Ones...

When It Matters Most

Life, Medicare, Health Insurance provide crucial health and financial security in times of need. We are committed to help you and your loved ones...

when it matters most.

DID YOU JUST DISCOVER YOUR PRESCRIPTION DRUG PLAN HAS A DEDUCTIBLE? WE CAN HELP!

(505) 306-3811

Compare prices among the nation’s most Trusted Insurers

Compare Prices Among the Nation’s Most Trusted Insurers

Get a Personalized Life or Health Insurance Quote

Complete the short survey below to receive a personalized quote from The Clowe Agency

Why should you work with The Clowe Agency

Our Trusted Advisors have access to a broad array of life and health insurance companies and products, and can help you with a variety of insurance needs, including Medicare Advantage and Supplement Plans, Final Expense, Mortgage Protection, Retirement Planning, and more.

Our Trusted Advisors undergo periodic and rigorous Continuing Education training, and are fully recognized by each state as AHIP Certified and a NIPR™️Trusted Advisor.

Expertise

Our Trusted Advisors are trained professionals who have a deep understanding of the different types of life and health insurance policies available and can help you choose the one that best meets your needs and goals.

Convenience

Our Trusted Advisors are a more convenient choice than trying to research and compare policies all on your own. We're here to do the legwork for you, comparing quotes from multiple life and health insurance companies and helping you understand the terms and conditions of each policy.

Committed to Service

Our Trusted Advisors provide personalized service and support to help you choose the right policy for your unique situation. We take the time to understand your health, financial needs and goals, and work with you to find a policy that fits your budget and provides the protection you need.

Services We Offer

Ready to Plan for Your Family’s Future?

Book a meeting with us below to discover your options

The Future of Life Insurance in 2025

1. Data-Driven Personalization

One of the most transformative trends in life insurance is the integration of big data and artificial intelligence (AI). Insurers are leveraging data from wearables, health apps, and IoT devices to offer hyper-personalized policies. By analyzing an individual's lifestyle, health metrics, and behavioral patterns, insurers can provide customized coverage, tailored premiums, and proactive health management suggestions.

For example, wearable devices like fitness trackers allow insurers to monitor policyholders' activity levels and heart health. In turn, customers who maintain a healthy lifestyle can benefit from lower premiums or rewards programs. This symbiotic relationship encourages healthier living and aligns with consumers' desire for value-driven services.

2. Embedded Insurance

Embedded insurance is becoming a significant game-changer. In 2025, life insurance products are increasingly integrated into everyday transactions and platforms. Whether it's buying a car, booking a flight, or signing up for a fitness membership, consumers are being offered life insurance seamlessly at the point of sale. This trend eliminates friction in the buying process, making life insurance more accessible and relevant.

3. Focus on Mental Health and Wellness

The industry is broadening its focus beyond traditional health metrics to include mental health and overall well-being. Insurers now recognize the profound impact of mental health on life expectancy and quality of life. Policies in 2025 often include wellness programs, mental health support services, and incentives for engaging in mindfulness practices.

By addressing mental health proactively, insurers can reduce claims related to stress-induced illnesses and improve customer satisfaction. It's a win-win for both the industry and its clients.

4. Digital Transformation and Blockchain

The adoption of blockchain technology and digital tools has revolutionized life insurance operations. Blockchain ensures transparency and security in policy issuance, claims processing, and fraud prevention. Smart contracts automate payouts, significantly reducing processing times and enhancing trust.

Furthermore, digital-first platforms and mobile apps dominate the customer experience. Insurers offer self-service portals where customers can manage policies, update information, and file claims seamlessly. These advancements cater to the tech-savvy, on-the-go generation that values convenience and efficiency.

5. Evolving Regulatory Landscape

The regulatory environment continues to evolve, pushing insurers to prioritize transparency, data protection, and ethical AI use. Governments and regulatory bodies are keen to ensure that technological advancements do not compromise consumer rights. In 2025, compliance with data privacy laws and ethical underwriting practices remains a top priority for insurers worldwide.

Challenges Ahead

While opportunities abound, the industry faces challenges such as addressing digital divide issues, ensuring fair AI usage, and adapting to economic uncertainties. Striking the right balance between innovation and inclusivity will be critical to long-term success.

Looking Ahead

The life insurance industry in 2025 is defined by its commitment to innovation, customer-centricity, and societal impact. By embracing technology, fostering trust, and addressing emerging risks, insurers are not just protecting lives but actively enhancing them. As the industry continues to evolve, it holds the promise of a more secure and inclusive future for all.

COMPANY

INSURANCE NEEDS

CUSTOMER CARE

LEGAL

Copyright 2026. The Clowe Agency. All Rights Reserved.